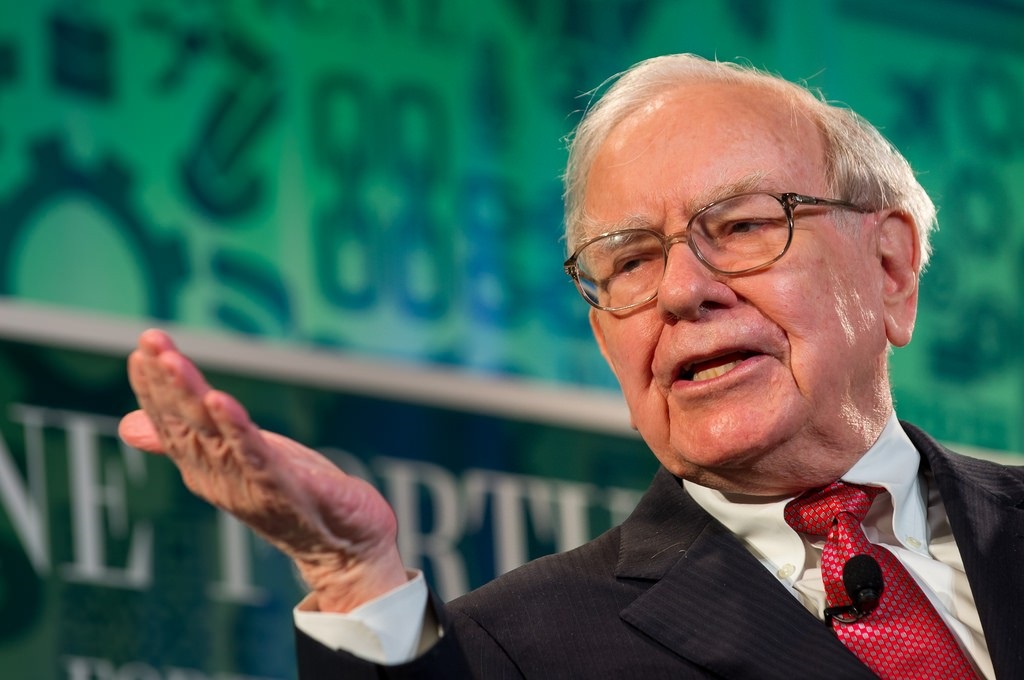

If you want to be successful in the stock market you must do what the most successful person in this industry did. And one of the most successful stock market investors of all time is Warren Buffett.

Warren Buffett is a renowned investor known for his value investing approach, in which he seeks out undervalued companies with strong growth potential.

He is the CEO of Berkshire Hathaway and is known for his discipline, thorough research, and long-term perspective in investing has brought him to the top 5 richest person in the world at more than 107 billion dollars of net worth in 2022

The following are the six greatest rules of stock investing we can learn from Warren Buffett

Rule Number 1. Focus on the long term

Warren Buffett is known for his long-term approach to investing.

Rather than trying to make quick profits by buying and selling stocks frequently, he focuses on finding good companies with strong potential for growth and holding onto those investments for the long term.

This means that he is willing to wait for the potential for a company to realize its growth potential, rather than trying to make short-term gains by trading in and out of the stock market. This approach can help to minimize risk and potentially increase returns over the long run.

One of the most popular example of all time is Coca-Cola

Warren Buffett has described Coca-Cola as a ‘Miracle Company’ and has been a long-term shareholder in the company. Berkshire Hathaway is now one of Coca-Cola’s largest shareholders.

Coca-Cola is a well-known and iconic brand with a strong presence in many countries around the world. The company has a large and loyal customer base, which helps to ensure a steady stream of revenue.

In addition, Coca-Cola has a competitive advantage in the beverage industry due to its diverse portfolio of products, which includes its flagship Coca-Cola brand as well as other popular brands such as Sprite, Fanta, and Dasani.

These brands have a strong market presence and are difficult for competitors to replicate. Furthermore, Coca-Cola has a strong financial performance, with consistent revenue and earnings growth over the years.

This, combined with the company’s strong brand and competitive advantage, likely made it an attractive investment for Warren Buffett and Berkshire Hathaway.

Rule Number 2. Look for companies with a competitive advantage

As a value investor, Warren Buffett looks for companies with a competitive advantage that can help them perform well over the long term.

One way a company can have a competitive advantage is by having a strong brand that is well-known and respected in its industry. A strong brand can help a company attract and retain customers, which can lead to a steady stream of revenue.

Another way a company can have a competitive advantage is by having a loyal customer base. A company with a large and loyal customer base is less vulnerable to competition and is more likely to be able to weather market downturns.

A company can also have a competitive advantage if it has a unique product or service that is difficult for competitors to replicate. This could be due to a patented technology, a proprietary manufacturing process, or other factors.

By looking for companies with these types of competitive advantages, Buffett is seeking out businesses that are well-positioned to perform well over the long term

One of the recent popular example is Apple

Apple is a well-known and respected company with a diverse range of products and services, including iPhones, iPads, Macs, and Apple Watch.

The company has a large and loyal customer base, which helps to ensure a steady stream of revenue.

Another reason is Apple’s financial performance. The company has consistently generated strong revenue and earnings growth over the years, and it has a strong balance sheet with a large cash reserve.

Finally, Apple has a competitive advantage in the technology industry due to its proprietary technologies and innovations, such as its iOS operating system and its proprietary chips and processors.

These technologies are difficult for competitors to replicate, which helps to give Apple a competitive advantage.These characteristics have made it an attractive investment for Warren Buffett and Berkshire Hathaway.

Rule Number 3. Do thorough research before making an investment

Doing thorough research before making an investment is critical for several reasons. First and foremost, it helps investors to make informed decisions and to better understand the risks and potential rewards of an investment.

By looking at a company’s financial statements, management team, and market conditions, investors can gain a better understanding of the company’s strengths and weaknesses and how it is positioned for growth.

Additionally, thorough research can help investors to identify potential red flags or risks that may not be immediately apparent. For example, a company with weak financials or poor management may be more vulnerable to market downturns or competitive challenges. By doing thorough research, investors can avoid making investments in companies that may have significant risks or that may be overvalued.

Overall, the importance of doing thorough research before making an investment cannot be overstated. It is a key part of the investment process and can help investors to make informed decisions and minimize risk.

Rule Number 4. Avoid risky and speculative investments

Risky and speculative investments are those that have a higher level of uncertainty and are more prone to significant price swings.

These types of investments may be more vulnerable to market risks or industry-specific challenges, and they can be difficult to accurately predict. By avoiding risky and speculative investments, investors can minimize their risk and potentially increase their chances of success over the long term.

This is especially important for long-term investors who are looking to build a diverse and stable portfolio. By diversifying their investments and avoiding highly speculative or volatile stocks, investors can potentially reduce their overall risk and increase their chances of success.

In addition to minimizing risk, avoiding risky and speculative investments is also in line with the principles of value investing. Value investing involves looking for undervalued companies with strong potential for growth and holding onto those investments for the long term.

By avoiding risky and speculative investments, investors can focus on finding good companies to invest in and holding onto those investments for the long term. This can help to minimize risk and potentially increase returns over the long run.

Rule Number 5. Don’t try to time the market

Trying to predict when to buy and sell stocks can be challenging and risky. Instead of trying to time the market, Warren Buffett advises investors to focus on finding good companies to invest in and holding onto those investments for the long term.

By following this approach, investors can potentially minimize risk and increase their chances of success over the long term. This approach is known as buy-and-hold investing and is a key part of Buffett’s investment strategy.

And Rule Number 6. Have a diversified portfolio

Diversification involves investing in a wide range of assets, such as stocks, bonds, and cash, and in a variety of industries and sectors. This can help to reduce the impact of any one investment on an investor’s overall portfolio.

For example, if an investor has a diverse portfolio and one of their investments underperforms, the overall impact on their portfolio may be minimized due to the performance of their other investments.

Buffett advocates for diversification and is known for investing in a wide range of companies across different industries and sectors. This helps to spread risk and potentially increase returns over the long term.

Overall, diversification is an important part of a successful investment strategy. By spreading risk across a variety of assets and industries, investors can potentially increase their chances of success and minimize the impact of any one investment on their overall portfolio.

Conclusion

Warren Buffett is a renowned investor known for his value investing approach, in which he seeks out undervalued companies with strong growth potential.

He is the CEO of Berkshire Hathaway and is known for his discipline, thorough research, and long-term perspective in investing.

Some of the key principles of his investment strategy include focusing on the long term, looking for companies with a competitive advantage, doing thorough research before making an investment, avoiding risky and speculative investments, not trying to time the market, and having a diversified portfolio.

By following these principles, investors can potentially minimize risk and increase their chances of success over the long term.

- Peter Lynch’s 4 Simple Rules to Outperform Most Investors in The Stock Market

- Peter Lynch’s 5 Types of Stocks That Will Maximize Your Returns