If you want to become a successful stock market investor today, stop over-complicate the strategy. Just follow the simple rules from the most successful investors, be patient, and stick to the rules. A guide from one of the most successful stock investor in the world that we’ll show you is Peter Lynch.

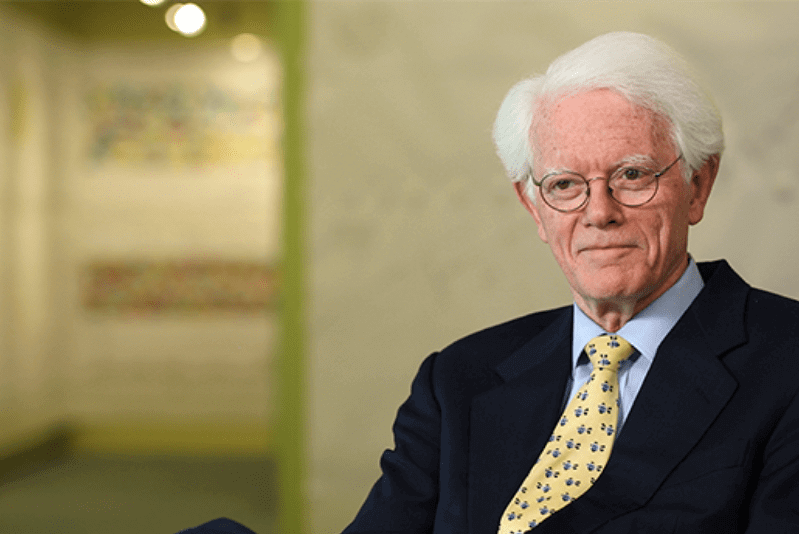

Peter Lynch gained widespread recognition as a successful portfolio manager. His exceptional performance can be attributed to his tenure at Fidelity Magellan Mutual Fund, where he served as portfolio manager starting in May 1977. When Lynch took on this role, the fund had assets worth $20 million.

However, under his leadership, the fund grew to become the largest mutual fund globally, with an annualized return that outperformed the market by an impressive 29% per year between 1977 and 1990.

Peter Lynch best selling book including One Up Wall Street, Beating the Street, and Learn to Earn.

And here are the 4 simple rules to become successful in stock investing you can learn from him.

Rule number 1. Only Invest in Stock You Understand.

According to Lynch, we can utilize our daily experiences and observations, along with our common sense, to identify potential investment opportunities.

He emphasized the importance of actively seeking out new ideas by paying attention to the world around us, whether through everyday activities like shopping or leisure activities such as travel.

As consumers make up a significant portion of the U.S. economy, it is worth considering the potential of companies that cater to consumer needs and preferences.

In short, if a product or service appeals to you as a consumer, it may also be a worthy investment opportunity.

Rule number 2. Always Do Your Homework.

While firsthand observations and anecdotal evidence can provide valuable initial insights, it is important to conduct thorough research to validate and support investment decisions.

Despite his emphasis on the use of everyday experiences and common sense, Peter Lynch recognized the importance of rigorous research in achieving successful outcomes.

When evaluating a potential investment, he emphasized the need to consider several fundamental values to determine if a stock is worth investing.

There are 3 places to look for, according to Lynch.

Place number 1. Percentage of Sales.

When evaluating a company’s potential as an investment, it is important to consider the percentage of sales that the product or service in question represents.

A high percentage of sales for a particular product or service indicates that it is a significant contributor to the company’s revenue.

Place number 2. Price-to-Earnings Growth or PEG Ratio.

It is advisable to examine the PEG ratio which reflects the valuation of the company in relation to its earnings growth rate.

A company with strong earnings growth and a reasonable PEG ratio may be a more attractive investment opportunity than one with a higher PEG ratio, which suggests that the market has already priced in a significant amount of expected growth.

And Place number 3. Cash position and Debt-to-Equity ratio.

It is beneficial to consider a company’s cash position and debt-to-equity ratio, as strong cash flows and careful asset management can provide flexibility in various market conditions.

Rule number 3. Invest Long-Term.

According to Lynch, stocks are relatively predictable over the long term, with surprises being the main factor that could impact their performance.

He did not attempt to predict the direction of the market or the overall economy, and instead focused on staying informed about the companies he owned, only selling when the investment story had changed.

This perspective highlights Lynch’s conviction in his investment philosophies and his approach of holding onto stocks as long as the underlying fundamentals remained favorable.

In a study he conducted, Lynch found that market timing, or attempting to predict the best times to buy and sell based on market movements, was not a consistently effective strategy.

In the study, he compared the returns of two investors who each invested $1,000 per year over a 30-year period, from 1965 to 1995.

The first investor invested on the highest day of the year each year, while the second investor invested on the lowest day of the year.

The results showed that the first investor earned a compounded return of 10.6% over the 30-year period, while the second investor earned an 11.7% compounded return.

These findings suggest that trying to time the market may not necessarily lead to better returns compared to a consistent, long-term approach.

Based on this study, Lynch concluded that attempting to predict short-term market fluctuations is not a worthwhile endeavor, as it can have a minimal impact on overall returns.

In the example above, even with the worst possible market timing, the difference in returns between the two investors was only 1.1% per year over a 30-year period.

Instead of trying to forecast market movements, Lynch believed that it was more important to focus on identifying strong companies, as their success would ultimately lead to appreciation in the value of their stocks. By keeping his investment strategy simple, Lynch was able to concentrate on the task of finding and evaluating high-quality companies.

Lynch coined the term ‘Tenbagger’ to refer to a stock that increases in value ten times, or 1000%.

These were the types of stocks he sought out while managing the Magellan fund. One key rule for finding a tenbagger, according to Lynch, is not to sell the stock even if it has appreciated significantly, such as by 40% or 100%.

Many fund managers may be inclined to sell their winning stocks while holding onto their losing positions, but Lynch believed that this approach, which he referred to as ‘Pulling the flowers and watering the weeds’, was not effective.

Instead, he advocated for a focus on identifying and holding onto high-potential stocks.

Rule number 4. One Characteristic of Stock to Be Aware

Lynch warns against the temptation to buy into the hype surrounding these stocks, as they may have experienced a temporary surge in value due to favorable publicity, but may not have long-term growth potential.

This can be especially relevant in today’s market, where social media and the internet can amplify the hype surrounding a particular stock, leading to a rapid increase in its price.

However, investors may eventually realize that these hot stocks do not have strong growth prospects, leading to a decline in their value.

It is therefore important to carefully research and evaluate a company’s fundamentals before making an investment decision.

Conclusion :

Peter Lynch was a highly successful portfolio manager known for his straightforward investment philosophy and his emphasis on conducting thorough research and identifying strong companies.

He believed in the importance of utilizing firsthand observations and common sense to identify potential investment opportunities, but also recognized the value of rigorously evaluating a company’s fundamentals before making a decision.

Lynch also cautioned against attempting to predict short-term market movements or succumbing to the hype surrounding hot stocks, which may not have long-term growth potential. Instead, he advocated for a focus on finding and holding onto high-quality companies for the long term.

- Peter Lynch’s 5 Types of Stocks That Will Maximize Your Returns

- Warren Buffett’s 6 Greatest Rules of Stock Investing